CNBC recently reported on the news that two-thirds of people who declared bankruptcy blamed a severe and unexpected illness for their financial woes. Like many people, they probably assumed their medical plan would pay the bills if they got sick.

Many of these unfortunates found out too late that health insurance doesn’t offer enough financial protection to weather a severe medical issue, like a stroke, heart disease, or cancer.

Part of personal financial planning should include considering critical illness protection to take care of bills that health insurance won’t cover. Affordable supplemental policies can provide cash payments and offer financial peace of mind.

Reason 1: Serious Illnesses Frequently Reduces Your Income!

A research study looked at financial outcomes for 300 cancer patients. Their average income loss totaled $50,000. Similarly, most people who suffer from a heart attack can’t return to work for at least three months.

Even without the burden of additional medical bills, patients must cope with lost income. Very often, this problem also affects other loved ones who step up to help.

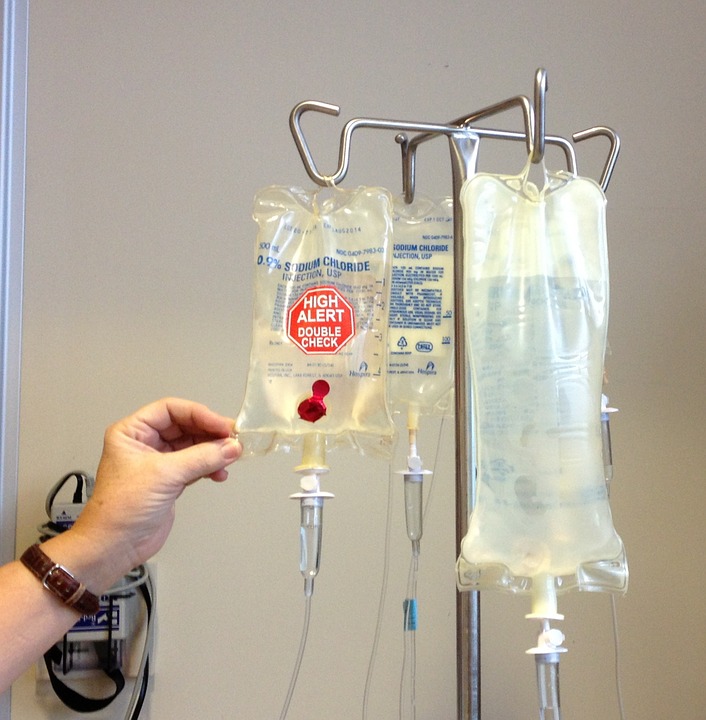

Reason 2: Health Insurance Won’t Cover All Expenses Associated With Serious Illnesses

Health insurance plans usually have deductibles and copays. Therefore, they rarely cover 100 percent of covered expenses until the patient has spent enough to reach the out-of-pocket maximum, typically adding up to many thousands of dollars.

Besides sharing costs for covered expenses, patients often need to pay more money for such vital needs as transportation to medical appointments, household help, and care for themselves and other family members, bills that health insurance doesn’t pay.

Reason 3: Supplemental Coverage for Critical Illnesses Doesn’t Cost A Lot

As with other insurance, premiums for this supplemental coverage may depend upon the coverage and the individual. Even so, many people are pleasantly surprised that a critical illness or cancer policy can cost as little as a few dollars a month.

These plans can protect individuals, couples, or entire families. Even better, premiums don’t usually increase yearly, unlike health insurance premiums.

How Does Coverage for Critical Illnesses Work?

Policies can vary by the insurer or specific benefits. Some plans offer cash payments based on various diseases or necessary treatments.

Many of the best policies will pay a generous lump sum cash benefit after the diagnosis of illnesses covered in the contract. Sometimes, these policies offer cash payments as high as $100,000 or more. What’s great is the insurance company will send the lump sum check directly to you and not to a medical provider.

An added benefit of having a critical illness or cancer policy is it provides you now the peace of mind to enable you to consider buying instead a higher deductible health insurance policy, saving a lot of monthly premium, since you now know that if you did unfortunately get diagnosed with a major illness, you’re financially well protected through this separate supplemental policy. This can be a win-win all around!

As the policy beneficiary, you can use this money in any way you need. In other words, you could:

- Use your funds to defray your deductible and other out-of-pocket medical expenses.

- You can also spend the money to keep up with your mortgage, light bill, and other costs.

- You’re even free to save the money if you don’t need to spend it all.

How to Find the Best Critical Illness or Cancer Policy for Your Needs

As an independent agency, our primary goal is to offer our clients financial peace of mind with affordable, practical coverage – personalized for each person’s specific needs and budget. To learn more contact us here to discuss your unique concerns about planning for the unexpected or just call us at 216-835-1255. We can also answer your questions about Health, Life, and Medicare insurance policies.